north carolina estate tax certification

North Carolina now combines your vehicle registration fees and property taxes into one renewal notice. I determined that this estate was subject to North Carolinas estate tax and I have filed with the clerk of superior court a certificate issued by the Secretary of Revenue that states that the estate tax liability has been satisfied.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

No other excise recordation or mortgage tax exists in South Carolina.

. North Carolina General Statute 105-307 states that an extension may be granted for good cause shown. Easily calculate the South Carolina title insurance rates and South Carolina property transfer tax. Angier Public Library Contact.

Oregon Real Estate License Education. I determined that this estate was not subject to North Carolinas estate tax the decedent died on or after January 1 1999 but prior to January 1 2013 and. The North Carolina County reviewing the tax status of the estate must be reported along with the file number it has assigned to this matter.

Angier Public Library 28 N Raleigh St Angier NC 27501 HOST. Sales and Use Tax. Estate Tax Certification For Decedents Dying On or After 1199 PDF 195 KB.

Certification of Disabled Veteran Form NCDVA-9 The NCDVA-9 Form must be filled out and returned with the Senior Citizen Disability Exclusion Application if you are Veteran who is permanently disabled. A four-wheel drive vehicle intended to be mounted with a water tank and hose and used for To a co-owner when there is no compensation for the transfer. Since we have been managing real estate schools and developing.

North Carolina Judicial Branch Search Menu Search. PO Box 25000 Raleigh NC 27640-0640. This calculator is designed to estimate the real estate tax proration between the home buyer seller at closing.

PARTIAL EXEMPTION - 40 MAXIMUM TAX In accordance with US Revenue Code IRC and NC General Statute 105-1876 b. Thats why we created the North Carolina Real Estate License Exam Prep NC-RELEP the way we did. Oklahoma Real Estate Continuing Education.

The recording fee is 185 for each five hundred dollars or fractional part of five hundred dollars. With refreshed content in 2018 this practice test contains 75 items based on the content outline of the national portion of the test for the following states. Visit the Tax Department Website Rockingham County is comprised of approximately 53954 real estate parcels 3000 businesses 94000 registered motor vehicles and 4350 personal property manufactured homes.

Once certified by the Veterans Benefit Administration the form will be returned to your. Business and Personal Property Extension Request Form. Will or Intestacy when no compensation has been paid to the estate.

In North Carolina all property tax laws are determined by the State Legislature. Estate Tax Certification For Decedents Dying On or After 1199 Files. Book Discussion with Local Authors of Angier North Carolina from an African American Perspective WHEN.

About sixty 60 days before your vehicle registration expires the North Carolina DMV will send a renewal notice to the address on record. This product must be purchased via the PSI Exams Online site. The Tax Assessor and Tax Collector is sworn to uphold and.

North Carolina Estate Forms Index The following statement is provided by order of the NC. NORTH CAROLINA ocean isle style. Property Tax - Forms Property Tax - Forms Taxes Forms.

To qualify for the disabled veteran homestead property tax relief under North Carolina law a person must meet the following criteria. Oregon Real Estate Continuing Education. Gift between spouse and.

88 North Carolina Decedent Name. Click the Buy Now button below to be taken there. 130 pm 300 pm Friday February 18 2022 WHERE.

Estate Tax Certification 87 North Carolina County Information. Simply close the closing date with the drop down box. Registered Office and Registered Agents street address mailing address if different from the street address of the PLLCs registered office and the name of the PLLCs initial registered agent are required.

QUICK LINKS Report a Concern Staff Directory Accessibility. Then enter the local county and school tax amount and. 10 Participation in the fee dispute resolution program of the North Carolina State Bar is mandatory when a client requests resolution of a disputed fee.

AAll official court forms are reproduced by permission of the North Carolina Administrative Office of the Courts. This process is known as Tax Tag Together. Customarily called documentary stamps or revenue stamps.

Individual income tax refund inquiries. This notice lists both vehicle registration fees and. This form should be completed if the North Carolina Decedent passed away on or after January 1 1999.

If you are having trouble. Find a courthouse Find my court date Pay my citation online. A lawyers obligation to respond timely to all requests for information from the fee dispute resolution facilitator continues even if the lawyer and the client reach a resolution of the dispute while the fee dispute petition is.

Deliver the full name of. The registered office street address and the registered mailing address must be located in North Carolina. Ohio Real Estate Continuing Education.

Tweets by NCDOR. This proration calculator should be useful for annual quarterly and semi-annual property tax proration at settlement calendar fiscal year. State Service Office NCDMVA - NCDVA9 251 North Main Street Room 190 Winston-Salem NC 27155.

Each form was current as of the date appearing in the lower left hand corner of Side One of Page One of the form but is subject to ongoing revision and may not still be current at. North Carolina Real Estate Continuing Education Courses. North Carolina Department of Revenue.

Mail or Fax Certification to. CO CT DC IA IN KY LA MD MA MI MN MS MT NE NH NJ NM OH OK OR PA SC TN VA and VI. North Carolina Practice Tests 130 questions North Carolina Sample Exam 105 questions We know the real estate licensing exam can be tough and very nerve-wracking to prepare for.

These files may not be suitable for users of assistive technology. North Dakota Real Estate Continuing Education.

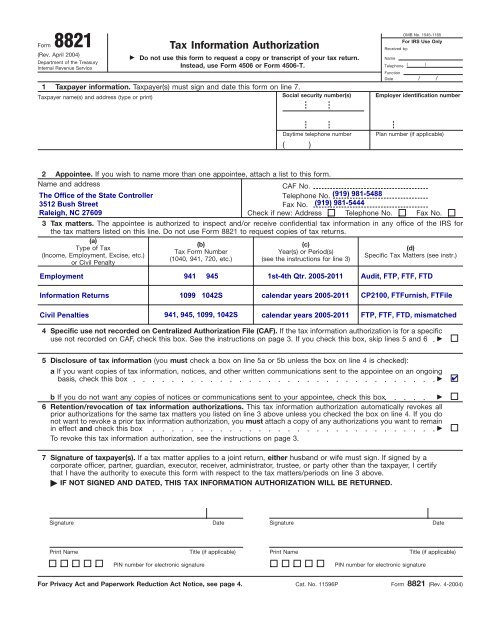

Irs Form 8821 Tax Information Authorization North Carolina Office

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

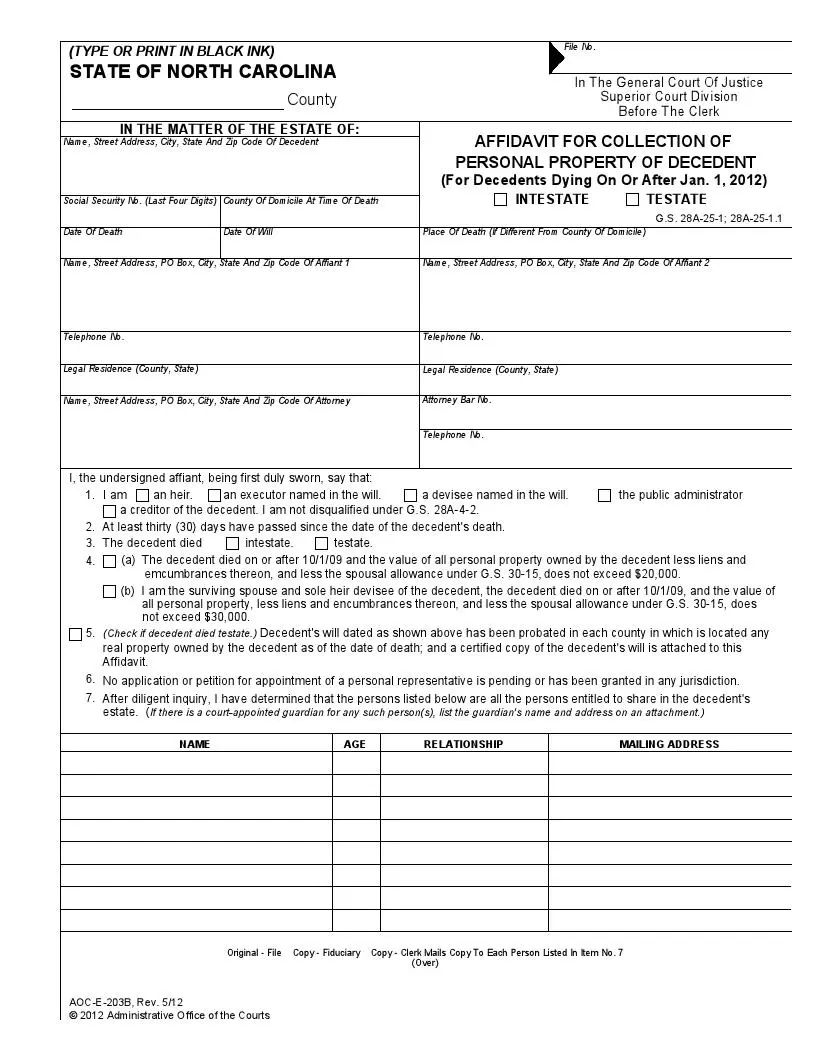

Free North Carolina Small Estate Affidavit Form Pdf Formspal

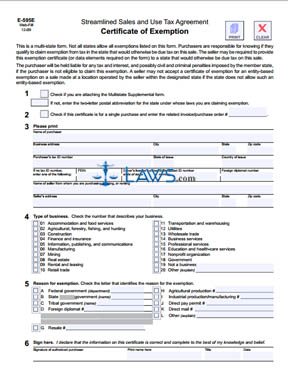

Free Form E 959e Streamlined Sales And Use Tax Agreement Certificate Of Exemption Free Legal Forms Laws Com

North Carolina Estate Tax Everything You Need To Know Smartasset